1. Lower capital tie-up and freed-up liquidity

With operational leasing, companies avoid tying up large amounts of capital in car purchases. A fixed monthly lease payment makes budgeting easier and frees up liquidity that would otherwise be locked in assets.

At Scalepoint, it’s the same principle. You rent a complete, ready-to-use claims management system paid for through a fixed annual subscription – resulting in something rare in IT: financial predictability.

2. Reduced risk and operational benefits

Operational leasing typically shifts certain risks – such as vehicle depreciation – to the leasing provider. Agreements often include service, maintenance, and insurance, reducing the administrative burden.

With Scalepoint, everything is included. This eliminates risks related to keeping up with technological change, writing requirements, development, and operations. You’re always on the latest version of the solution.

Because the solution is fully developed – and already used by other insurers – you can redirect resources to your core business. Implementation takes months, not years.

3. Scalepoint is different – because SaaS isn’t just SaaS

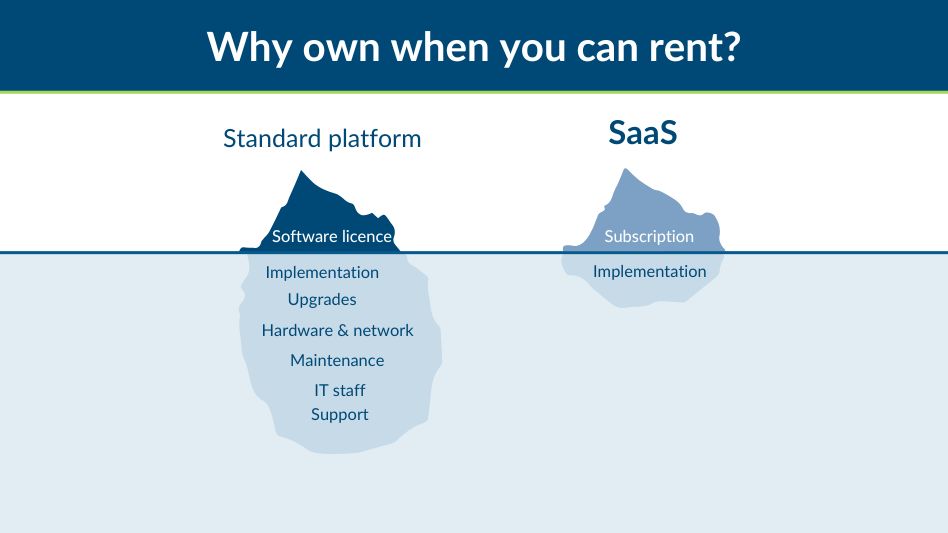

Wait, what? The special thing about our delivery model is that it’s multi-tenant SaaS. That means you share the solution with other insurers and benefit from economies of scale. The platform is pre-configured by country but can be tailored to your exact needs. You pay a yearly subscription and a one-time implementation cost – mostly related to integrations and our configuration of business rules based on best practice and your input. In other words, there’s no need to reinvent the wheel.

We stay ahead of regulations and security – and to end in car rental lingo: you’ll never notice others are “driving the same car.”

You can read more about our delivery model, multi-tenant SaaS, here.