AI holds potential throughout the insurance value chain – from underwriting and policy management to claims and customer service. But according to EIOPA, the benefits must be realized in a way that is fair, explainable, and under human oversight.

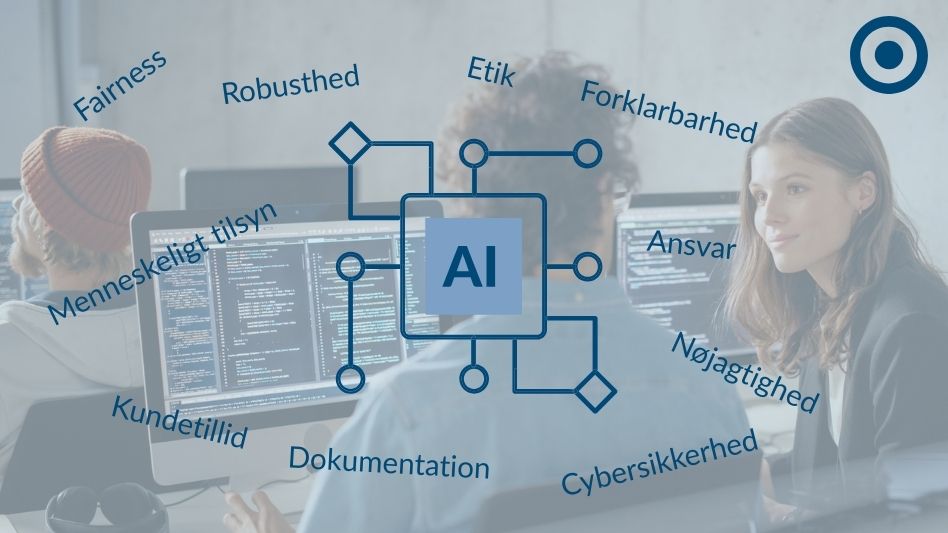

EIOPA’s key principles are:

Fairness and ethics

AI should be applied with a customer-centric focus. Insurers must ensure fair treatment, prevent bias, train employees, and provide customers with clear complaint channels.

Documentation and explainability

Data and models must be reproducible, and AI outcomes should be explainable in a meaningful way so that both customers and regulators understand the reasoning behind them.

Human oversight

AI must be monitored throughout its entire lifecycle. Roles and responsibilities should be clearly defined, and employees must be equipped to detect bias, manage risks, and ensure the system functions as intended.

Accuracy, robustness, and cybersecurity

AI systems must remain reliable over time, resilient against errors and attacks, and supported by contingency plans that safeguard operations and business continuity.

At Scalepoint, we continuously explore new AI technologies. We only adopt them when we are confident they can be used responsibly – and always in close dialogue with our customers. This way, we combine innovation with compliance, transparency, and customer trust.

Read the full EIOPA opinion here.

Discover how we work with automation and AI in insurance here.